Background: Shadow banks and brown loans

Combating climate change is one of the major challenges of our times. Banks and capital markets can influence firms’ impact on the climate because they enable companies to obtain funding and decide which prize companies must pay to fund their activities. Whereas banks are regulated and therefore must take risks of their clients into account, shadow banks can perform similar activities without adhering to the same rules. Shadow banks are willing to share the risks of loans with banks and buy high-risk loans from banks and trade these afterwards on secondary markets. And they do so to a large extent: In the year 2021, shadow banks purchased 75% of all newly issued high-risk loans from the dollar-denominated syndicated loan market. Shadow banks’ investment decisions have potentially a large first order impact on emissions of firms, as shadow banks’ willingness to purchase loans of high emission firms (“brown firms”) impacts the price to which brown firms can obtain funding.

Shadow banks invest in brown loans when climate change is salient

We assess how shadow banks change their exposure to brown loans, when society pays attention to climate change. We show how shadow banks’ purchases of brown loans correlate with measures for public attention on climate change. When climate change is a prevalent topic in newspaper articles, in particular negative news on climate change, then we define these periods as high attention periods. We assume that during these periods, society is particularly eager to combat climate change.

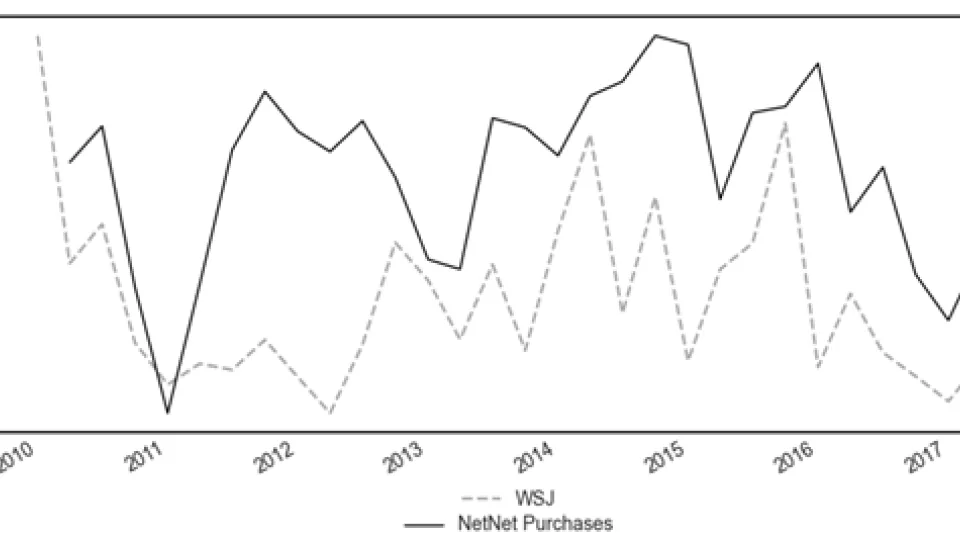

Shadow banks’ purchasing behavior is measured through the increase in their net purchases of brown loans. This variable measures whether shadow banks tilt their portfolio towards brown loans. Figure 1 shows this measure of portfolio tilting over time (solid line), as well as an index that captures attention to climate change (dotted line). We can see that there is a positive relationship between society’s attention to climate change (dotted line) and shadow banks’ brownness of new purchases (solid line). For example, between 2015 and mid-2017, it can be seen that the solid line, i.e. net purchases of brown loans of shadow banks, follows the development of attention to climate change.

Using statistical methods, we find the following: While attention to climate change is high, brown loans fall in price. This makes sense – when society wants to fight climate change, brown loans carry extra risk in the sense that the companies that borrowed the money might have to face more regulation or face the risk that they might not operate anymore in the future. Shadow banks do not mind taking on these risks and are willing to buy these cheaper loans. In fact, as shadow banks are less in the view of the public, are relatively short lived, and have an institutional investor base, in contrast to other intermediaries which are exposed to retail investors, they can invest in while others are divesting from brown loans.

Further, we assess whether shadow banks from managers that committed to take sustainability criterion into consideration in their investment decisions behave differently and refrain from purchasing brown loans. We compare shadow banks whose managers signed the so called “Principles of Responsible Investments”, an initiative by the United Nations (UN), to those whose managers did not sign the initiative. However, we find that shadow banks whose managers committed to sustainability goals do not behave differently. They equally load up on brown loans when climate change is a pivotal topic in society.

Policy Implications

Banks must adhere to regulations because they play a pivotal role in the economy. For example, they must form expectations about the riskiness of their borrowers and need to adjust their capital holdings accordingly. Shadow banks, i.e. bank-like institutions that can perform similar activities, take over risks from the banking sector. If society wants that banks take the carbon footprint of their customers into account in the prizing decisions of loans, then policy makers should have an eye on shadow banks, too, to avoid that they, as it was the case in the buildup of the global financial crisis of 2008, absorb excessive risks from traditional banks. By purchasing brown loans, shadow banks enable firms with a large carbon footprint to continue obtaining funding at a lower price without incentives for these firms to reduce their carbon footprint.

*WSJ: Wall Street Journal Index by Engle et al. (2020): “Hedging Climate Change News”, Review of Financial Studies, 33, pages 1184–1216.

**Net Purchases =(P(brown) – S(brown)) – (P(non-brown) – S(non-brown), where P: purchases and S:sales, normalized by total holdings.

Hackenberg, K., Klaus, V., Klinger, S., Sondershaus, T.: “Taking advantage of attention to climate change: CLOs’ trading of brown loans”, preprint, accessible here.