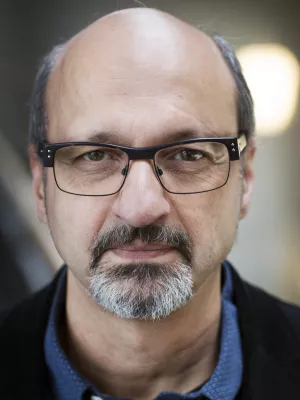

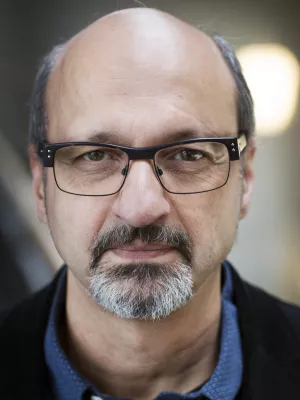

Hossein Asgharian

Professor

Macro-Finance Determinants of the Long-Run Stock-Bond Correlation: The DCC-MIDAS Specification

Author

Summary, in English

We investigate long-run stock–bond correlation using a model that combines the dynamic conditional correlation model with the mixed-data sampling approach and allows long-run correlation to be affected by macro-finance factors (historical and forecasts). We use macro-finance factors related to inflation and interest rates, illiquidity, state of the economy, and market uncertainty. Macro-finance factors, particularly their forecasts, are good at forecasting long-run stock–bond correlation. Supporting the flight-to-quality phenomenon, long-run correlation tends to be small and negative when the economy is weak.

Department/s

- Department of Economics

Publishing year

2016

Language

English

Pages

617-642

Publication/Series

Journal of Financial Econometrics

Volume

14

Issue

3

Document type

Journal article

Publisher

Oxford University Press

Topic

- Economics

Keywords

- DCC-MIDAS model

- Long-run correlation

- Macro-finance factors

- Stock–bond correlation

Status

Published

ISBN/ISSN/Other

- ISSN: 1479-8409