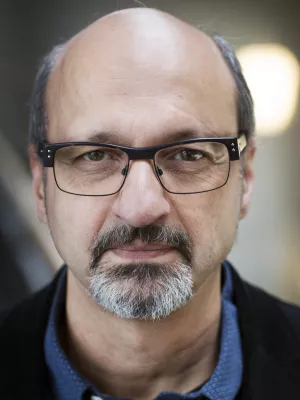

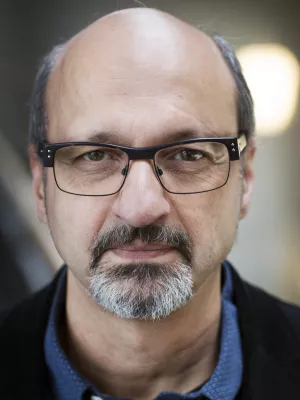

Hossein Asgharian

Professor

Non-linearity in the impact of bankruptcy risk on leverage

Author

Editor

- Emanuel Alfranseder

Summary, in English

The paper investigates the effect of bankruptcy risk on firms’ financing decisions. More specifically, we analyze if a higher probability of bankruptcy reduces incentives for debt financing due to an increase in expected bankruptcy cost. We argue that an increase in bankruptcy risk affects financial decisions only when the probability of bankruptcy is sufficiently high. We therefore model a nonlinear relationship between changes in leverage and bankruptcy risk. Our findings show that an increase in bankruptcy risk has a negative impact on changes in leverage and the impact is clearly nonlinear.

Department/s

- Department of Economics

Publishing year

2015

Language

English

Pages

119-137

Publication/Series

Lund Economic Studies

Issue

188

Document type

Book chapter

Publisher

Lund University

Topic

- Business Administration

Status

Published

ISBN/ISSN/Other

- ISSN: 0460-0029

- ISBN: 978-91-7623-303-0