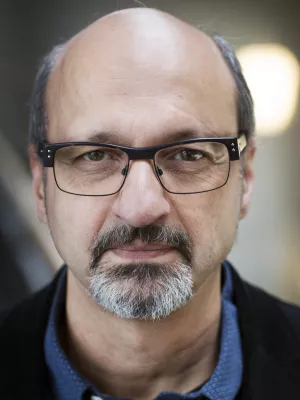

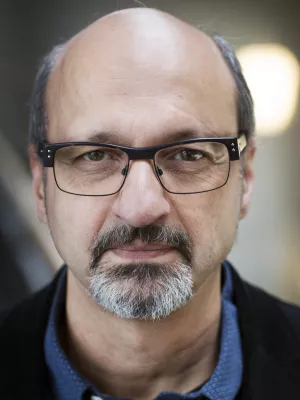

Hossein Asgharian

Professor

Long- and short-run components of factor betas : Implications for stock pricing

Author

Summary, in English

We propose a new model that estimates the long- and short-run components of the variances and covariances. The advantage of our model to the existing DCC-based models is that it uses the same form for both the variances and covariances and estimates these moments simultaneously. We apply this model to obtain long- and short-run factor betas for industry test portfolios. We find that the risk premium related to the short-run market beta is significantly positive, irrespective of the choice of test portfolio. Further, the risk premia for the short-run betas of all the risk factors are significant outside recessions.

Department/s

- Department of Economics

Publishing year

2021-09

Language

English

Publication/Series

Journal of International Financial Markets, Institutions and Money

Volume

74

Document type

Journal article

Publisher

North-Holland

Topic

- Economics

Keywords

- Component GARCH model

- Long-run betas

- MIDAS

- Risk premia

- Short-run betas

Status

Published

ISBN/ISSN/Other

- ISSN: 1042-4431