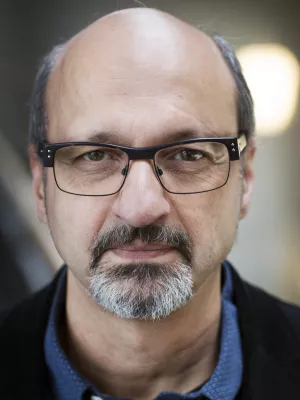

Hossein Asgharian

Professor

The Importance of the Macroeconomic Variables in Forecasting Stock Return Variance: A GARCH-MIDAS Approach

Author

Summary, in English

This paper applies the GARCH-MIDAS (mixed data sampling) model to examine whether information contained in macroeconomic variables can help to predict short-term and long-term components of the return variance. A principal component analysis is used to incorporate the information contained in different variables. Our results show that including low-frequency macroeconomic information in the GARCH-MIDAS model improves the prediction ability of the model, particularly for the long-term variance component. Moreover, the GARCH-MIDAS model augmented with the first principal component outperforms all other specifications, indicating that the constructed principal component can be considered as a good proxy of the business cycle. Copyright (c) 2013 John Wiley & Sons, Ltd.

Department/s

- Department of Economics

- Department of Statistics

Publishing year

2013

Language

English

Pages

600-612

Publication/Series

Journal of Forecasting

Volume

32

Issue

7

Document type

Journal article

Publisher

John Wiley & Sons Inc.

Topic

- Probability Theory and Statistics

- Economics

Keywords

- Mixed data sampling

- long-term variance component

- macroeconomic

- variables

- principal component

- variance prediction

Status

Published

ISBN/ISSN/Other

- ISSN: 1099-131X