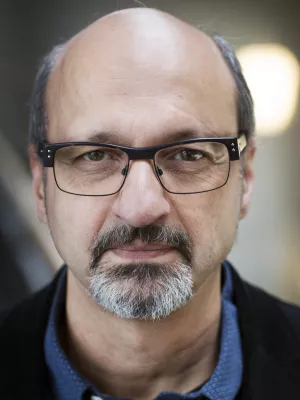

Hossein Asgharian

Professor

Systemic Risk and Centrality Revisited: The Role of Interactions

Author

Summary, in English

We analyze to what extent the contribution of banks to systemic risk depends on their centrality in financial networks. We find that centrality is an important determinant of systemic risk, but not primarily by its direct effect. Its main influence is to make other risk measures, such as probability of default, more important for highly connected banks. Neglecting the indirect effect of centrality may severely underestimate or overestimate the systemic risk of banks. We also show that, even though size and centrality are related, the inclusion of centrality provides valuable information when assessing the systemic importance of banks.

Department/s

- Department of Economics

Publishing year

2022

Language

English

Pages

1199-1226

Publication/Series

European Financial Management

Volume

28

Issue

5

Document type

Journal article

Publisher

Wiley-Blackwell

Topic

- Economics and Business

Status

Published

ISBN/ISSN/Other

- ISSN: 1468-036X